Titanium

The card that carries more weight

150K

Bonus Qantas Points when spending $5,000 or more within 90 days of card approval.1

1.25

Qantas Points per dollar on Domestic Spend (up to AU$12,500 per statement period)2

10%

Discount on the base fare of eligible Qantas flights for up to 2 adults, 2 children and 2 infants per booking, twice per Anniversary Year via the booking portal3

2

Qantas First Lounge Invitations4

20%

Bonus Status Credits on eligible flights purchased on your card5

$1,200

Annual fee6

Accelerate your Status Credits

The only credit card to offer 20% bonus Status Credits (to both primary and additional cardholders), when you book and pay for your travel on eligible Qantas flights using your card5.

Realise the savings with benefits that reward

Qantas Money Titanium is the card with benefits designed to help you get true value from your membership. With a 10% saving on the base fare of eligible Qantas operated flights3 for up to two bookings per Anniversary Year for two adults, two children and two infants on all fare classes (both international and domestic), for example, you have the potential to save thousands on Qantas First international travel. It is just one way your card helps to make the journey even more rewarding. The Qantas Money Titanium credit card is yours for an annual fee of $1,200.6

The card that carries more weight

A unique metal card that is heavy on benefits including accelerated Status Credits5, flight savings3 and a high earn rate.2

Complimentary First Lounge Invitations

Make the journey even more enjoyable with two Complimentary Qantas First Lounge Invitations4 and two additional Lounge Invitations per year. They are yours to enjoy with your Qantas Money Titanium Credit Card.

Exclusive Qantas privileges, rewards and benefits

Complimentary Travel Insurance

With cover that includes medical emergency, travel cancellation and purchase protection. Your additional cardholders are also covered - even when they are not travelling with you7.

Qantas Wine Premium Membership

Enjoy a selection of specially curated wine, Champagne, beer and spirits; as well as free delivery with your complimentary Qantas Wine Premium Membership.10 You will also earn an additional 3 points on top of any other Qantas Points earned with your card when you purchase from Qantas Wine using your Qantas Frequent Flyer details.

Card Offers

Make shopping more rewarding by activating offers to earn bonus Qantas Points12 when you shop at your favourite stores.

Qantas Wellbeing Rewards

Your Qantas Money Titanium Credit Card offers you another way to increase your points earning potential with up to 20,000 points a year through the Qantas Wellbeing App.11 Download the App to start earning points for everyday activities.

Uncapped earn rate

The potential to earn uncapped Qantas Points each time you use your Qantas Money Titanium Credit Card on eligible spend both at home and abroad.2

1.25

Qantas Points per dollar on Domestic Spend (up to AU$12,500 per statement period)2

2

Qantas Points per dollar on International Spend2

2

Additional Qantas Points per dollar on Qantas Spend2

What is the annual fee?

Primary Cardholder Annual Fee2 | $1,200 per year |

|---|

What are the interest rates?

Retail Purchase Rate | 20.99% p.a. |

|---|---|

Cash Advance Rate | 21.99% p.a. |

Interest-free period7 | Up to 44 days |

Balance Transfers | 0% p.a. for 6 months. Reverts to Cash Advance rate after 6 months.4 |

Enjoy exclusive services to help you manage your card and benefits

We are at your service

Should you require assistance – for instance, with a restaurant reservation or travel booking – your dedicated Concierge is only a phone call away, ready to help.8

Instalment Plans9

Pay off purchases on your statement in manageable monthly repayments at a special rate over a set term.

Compatible with digital wallets

Make safe and contactless payments using Apple Pay & Google Pay. Just load the card to your digital wallet, tap and go.

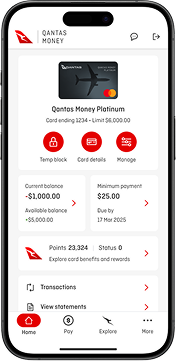

Download the Qantas Money Credit Cards App today.

Designed to work with your Qantas Money Credit Card, get the secure and easy-to-use App from the App Store or Google Play to see your credit card balance, due dates, transactions and more.

Help is always at hand

With access to millions of Mastercard11 locations worldwide and your dedicated concierge12, you can count on us whether you're at home or abroad.

Fraud protection

Feel safe with the built-in protection of Mastercard Zero Liability.9 You must take care to protect your card from theft or loss, and notify us immediately if your card is lost or stolen.

Mastercard ID Theft ProtectionTM

Identity theft can happen in a split second. But once you activate this service, should your personal information ever be compromised, Mastercard ID Theft Protection™ is with you 24/7 to detect potential fraud, alert you of suspicious activity that it traces, and combat identity theft threats.15

Dedicated concierge

Our Qantas Premier Concierge service is just a phone call away, anytime you need assistance – from restaurant reservations to travel bookings.12

Frequently asked questions

Find answers online to commonly asked questions about the Qantas Premier credit card. See the most common topics and more.

Apply

To apply for the Qantas Money Everyday Credit Card you must:

- Earn a recommended minimum income of $35,000 per year

- Be at least 18 years old

- Be a permanent Australian resident

- Have an Australian mobile and residential address

- Be a Qantas Frequent Flyer member

- Be a new primary cardholder

It should take about 10 minutes, you’ll need these handy:

- Australian passport

- Foreign passport

- Australian Driver Licence

If you do not hold a standard form of personal identification, please call us on 1300 992 700.

Other cards you may be interested in

Important Information

National Australia Bank Limited (ABN 12 004 044 937, AFSL and Australian Credit Licence 230686) ("NAB") is the Credit Provider and Issuer of Qantas Money Credit Cards on behalf of Qantas Airways Limited ABN 16 009 661 901.

Mastercard® is a registered trademark and the circles design is a trademark of Mastercard International Incorporated. Go to mastercard.com.au for more information.

-

The Status Credits Benefits are awarded to the Qantas Frequent Flyer member who holds a Qantas Money Titanium credit card and flies on a Qantas operated and marketed flight booked with a Qantas Money Titanium credit card. Flights must be booked via Qantas.com or the Qantas Contact Centre (not via the Concierge), and the person travelling must be a cardholder. The offer cannot be used to move you from Platinum to Platinum One Qantas Frequent Flyer membership nor can a Platinum One member use the Status Credits to retain the Platinum One membership status. Status Credit Benefits will also not contribute to Lifetime Status, Loyalty bonuses, Platinum Bonus Reward, or Platinum One Member additional benefits and will not be earned in conjunction with other Status Credit promotions unless otherwise specified. The Status Credit Benefits is subject to change. For full terms and conditions see the Qantas Money Titanium Credit Card Benefit Terms and Conditions.

-

The Discounted Fares Benefit is available for up to two adults, two children and two infants per booking, twice per Qantas Money Titanium primary cardholder Credit Card per Anniversary Year on domestic and international flights operated by Qantas and QantasLink. The Discounted Fare Benefit only applies to the base fare and does not apply to any carrier charges, taxes and other fees that may be included in the total fare price. The base fare is the initial price of the flight amount, and does not include any additional costs such as taxes, fees and other charges. The Discounted Fares Benefit is not available on flights that form part of a Multi-City Flight Itinerary or Mixed-Class Flight Itinerary. The booking must be made by you through the booking portal available via your Qantas Money Credit Cards App or Online Access and you must pay for the booking in full using your Qantas Money Titanium credit card. The Discounted Fares Benefit is available on all fares including sale class fares, however it cannot be combined with any other offer, discount or promotion unless otherwise specified. The Discounted Fare Benefit is subject to change. For full terms and conditions see the Qantas Money Titanium Credit Card Benefit Terms and Conditions.

-

Earn rate for the Qantas Money Titanium credit card: 2 Qantas Points per whole AU$1 equivalent on International Spend; 1.25 Qantas Points per whole AU$1 on Domestic Spend up to and including AU$12,500 each Statement Period, 0.5 Qantas Points per whole AU$1 spent above AU$12,500 each Statement Period: plus 2 Additional Qantas Points per whole AU$1 on Qantas Spend. Eligible purchases are Eligible Transactions for Domestic Spend, International Spend and Qantas Spend as defined in Qantas Money Credit Card Rewards Terms and Conditions found at www.qantasmoney.com/terms-and-forms.

-

The Qantas Money Titanium Primary Cardholder is entitled to two single-entry Complimentary Lounge Invitations to the Qantas First Lounges in Sydney, Melbourne or Los Angeles and two single-entry Complimentary Lounge Invitations for use at domestic Qantas Club Lounges or Qantas operated International Business Lounges (excluding Los Angeles Tom Bradley Terminal International Business Lounge) per anniversary year in accordance with the Qantas Money Titanium Credit Card Benefit Terms and Conditions. Access and use are subject to the Complimentary Lounge Invitation Terms and Conditions and the Lounge Entry Terms and Conditions. The Complimentary Lounge Invitation is able to be linked to another passenger travelling with the Primary Cardholder when travelling under the same booking. For Qantas Lounge locations visit here.

-

An annual membership fee of $99 usually applies for Qantas Wine Premium Membership but this will be waived so long as you remain the primary cardholder of Qantas Money Titanium credit card. Qantas Wine Premium Membership and its benefits are subject to the Qantas Wine Terms and Conditions. Liquor Act 2007 (NSW): No alcohol can be sold or supplied to anyone under 18. It’s against the law. Licence Number: NSW LIQP770016736, NT IRL0201, SA 57900154.

-

The Qantas Wellbeing App is offered by Qantas and you must be a member of the Qantas Frequent Flyer (QFF) program and be 13 years of age or over to use it. Conditions apply and are available at https://insurance.qantas.com/termsofuse. Membership and Qantas Points are subject to the Qantas Frequent Flyer Terms and Conditions available at www.qantas.com/au/en/frequent-flyer/discover-and-join/terms-and-conditions.html. Each Qantas Money Titanium Primary Cardholder can earn up to 20,000 Qantas Points in a year through the App as part of this offer. To earn 20,000 points, you must complete the highest daily and weekly challenges, win every weekly group challenge and complete all checks. Qantas Points earned via the App will be credited to your QFF account on a fortnightly basis. Qantas may amend or withdraw this offer including points offers for activities within the App at any time.

-

Complimentary Travel Insurance is issued by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) ("Chubb") and is subject to the terms, conditions, excess, limits and exclusions set out in the Qantas Money Titanium Credit Card Complimentary Insurance Terms and Conditions arranged under a master policy of insurance between Chubb and National Australia Bank Limited (ABN 12 004 044 937, AFSL and Australian Credit Licence 230686) (“NAB”), the issuer of your card. Chubb only provides general advice and does not consider your objectives, financial situation or needs. To decide if this insurance is right for you, please read the Qantas Money Titanium Credit Card Complimentary Insurance Terms and Conditions. NAB does not guarantee this insurance.

The Qantas Money Credit Cards App is owned and operated by NAB and supported on iOS15+ and Android 10+.