Qantas Money Platinum

120k PTS

80,000 Bonus Qantas Points1

$349

Reduced first year annual fee2

0% P.A.

For 12 months on Balance Transfers

Earn up to 120,000 bonus Qantas Points. New cardholders receive 80,000 bonus Qantas Points when $5,000 or more is spent on eligible purchases within 90 days from card approval.1 Plus an additional 40,000 bonus points if you haven’t earned Qantas Points with a credit card in the last 24 months.1

There’s more to enjoy with Qantas Money Platinum

Your journey will feel special, even on the ground, with the Qantas Money Platinum Credit Card.

Complimentary Lounge Invitations4

Relax with 2 single-entry Complimentary Lounge Invitations per year to Qantas Club Domestic or Qantas Operated International Business Lounges, complete with complimentary food, beverages and Wi-Fi.

Discounted companion fares5

Get up to 20% off selected domestic flights for you and 8 friends, once per Anniversary Year. Book via the booking portal on your Qantas Money Credit Card account.

Reduced First Year Annual Fee2

Take advantage of a discounted $349 first year annual fee, usually $399.

Compatible with digital wallets

Make safe and contactless payments using Apple Pay & Google Pay. Just load the card to your digital wallet, tap and go.

Be rewarded with uncapped points potential

There’s no limit to the number of Qantas Points you can earn – at home or overseas.6

1.5

Per whole AU$1 on International Spend6

1

Per whole AU$1 on Domestic Spend (up to AU$10,000 per statement period, then 0.5 points per whole AU$1 spent thereafter)6

1

Additional point per whole AU$1 on selected Qantas products and services6

What is the annual fee?

Apply for a Qantas Money Platinum Credit Card now and save on the first year's annual fee.

Primary Cardholder Annual Fee2 | $399 per year. $349 annual fee for the first year. |

|---|

What are the interest rates?

Retail Purchase Rate | 20.99% p.a. |

|---|---|

Cash Advance Rate | 21.99% p.a. |

Interest-free period7 | Up to 44 days |

Balance Transfers | 0% p.a. for 12 months, with a 3% Balance Transfer Fee2. Reverts to Cash Advance Rate after 12 months. |

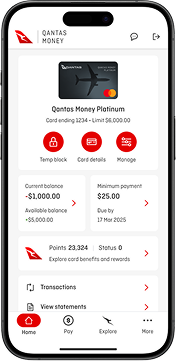

Ways to manage your credit card repayments

Download the Qantas Money Credit Cards App today.

Designed to work with your Qantas Money Credit Card, get the secure and easy-to-use App from the App Store or Google Play to see your credit card balance, due dates, transactions and more.

Help is always at hand

With access to millions of Mastercard11 locations worldwide and your dedicated concierge12, you can count on us whether you're at home or abroad.

Fraud protection

Feel safe with the built-in protection of Mastercard Zero Liability.9 You must take care to protect your card from theft or loss, and notify us immediately if your card is lost or stolen.

Mastercard ID Theft ProtectionTM

Identity theft can happen in a split second. But once you activate this service, should your personal information ever be compromised, Mastercard ID Theft Protection™ is with you 24/7 to detect potential fraud, alert you of suspicious activity that it traces, and combat identity theft threats.15

Dedicated concierge

Our Qantas Premier Concierge service is just a phone call away, anytime you need assistance – from restaurant reservations to travel bookings.12

Frequently asked questions

Find answers online to commonly asked questions about the Qantas Premier credit card. See the most common topics and more.

Apply

To apply for the Qantas Money Platinum credit card you must:

- Earn a recommended minimum income of $35,000 per year

- Be at least 18 years old

- Be a permanent Australian resident

- Have an Australian mobile and residential address

- Be a Qantas Frequent Flyer member

- Be a new primary cardholder

It should take about 10 minutes, you’ll need these handy:

- Australian passport

- Foreign passport

- Australian Driver Licence

If you do not hold a standard form of personal identification, please call us on 1300 992 700.

Other cards you may be interested in

Important Information

National Australia Bank Limited (ABN 12 004 044 937, AFSL and Australian Credit Licence 230686) ("NAB") is the Credit Provider and Issuer of Qantas Money Credit Cards on behalf of Qantas Airways Limited ABN 16 009 661 901.

To view the respective Target Market Determination (TMD) related to these products, please visit the TMD page.

All applications are subject to credit criteria. Fees, charges and Terms & Conditions apply. As part of your application, we will conduct a credit check, which may include a review of your credit history and rating. Making multiple applications in a short period could negatively affect your score and approval chances.

Mastercard® is a registered trademark and the circles design is a trademark of Mastercard International Incorporated. Go to mastercard.com.au for more information.

-

Offer commenced 5 March 2026. To be eligible for up to 120,000 bonus Qantas Points, you must apply for a new Qantas Money Platinum Credit Card before the offer is withdrawn. 80,000 Qantas Points will be awarded when $5,000 or more is spent on eligible purchases within 90 days from card approval. Eligible purchases must be processed and charged to your account in the first 90 days from the account approval. Eligible purchases do not include Cash Advances, Balance Transfers, Refunds, Chargebacks and Special Promotions. An additional 40,000 bonus Qantas Points offer is available to approved cardholders who have met the criteria for the 80,000 bonus points and have not earned Qantas Points on a credit or charge card into their Qantas Frequent Flyer account within the previous 24 months from card application (limited to one per Qantas Frequent Flyer or Qantas Business Rewards member only). Members are not eligible for more than one first-time Qantas Points earning credit cardholder bonus within the last 24 months. In the event of multiple new cardholder Bonus Points offers in the market for the same offer period, eligible members will be provided with the highest bonus points offer. This offer cannot be combined with any other Qantas branded credit card offer. Bonus Qantas Points will ordinarily be credited within 2 months of meeting the spend criteria. Any bonus Qantas Points will be forfeited if you no longer hold or close your Qantas Money Platinum Credit Card Account before they appear in your Qantas Frequent Flyer Account. All rewards are subject to the Qantas Money Credit Card Rewards Terms and Conditions. The account needs to be in good standing (for example - your account is not in default, suspended or closed) for bonus points to be awarded. Offer may be varied or withdrawn at any time.

-

Offer commenced 8 September 2025. A discounted annual fee of $349 applies if the first use of the Account (being when a transaction is first debited to the Account including Balance Transfers) is within 12 months from the day we approve your Account. Otherwise, the standard annual fee, currently $399 will apply for the first annual fee. After that, the standard annual fee, currently $399, will be debited each year on the last day of the Statement Period in which the anniversary of the day we approved your Account occurs. An additional cardholder annual fee, currently $50, applies per additional cardholder. These fees are subject to change.

-

Offer commenced 8 September 2025. New Qantas Money Platinum credit cardholders only. Your total balance transfers may not exceed 80% of your credit limit. Before making a Balance Transfer consider the following important information: the 0% p.a. interest rate applies to balances transferred and the balance transfer fee, for a period of 12 months. The 12 month promotional period commences once the Balance Transfer is processed. The balance transfer fee is 3% of the balance transferred and will be added to your outstanding balance on the day or the day after your balance transfer is processed. At the end of the Balance Transfer period, the interest rate on any outstanding transferred balance, and the balance transfer fee, will revert to the variable Cash Advance Rate, currently 21.99% p.a. For important information to consider before taking up a Balance Transfer, please click here. Offer may be varied or withdrawn at any time.

-

Qantas Money Platinum Primary Cardholders are entitled to 2 single-entry Complimentary Lounge Invitations per anniversary year for use at domestic Qantas Club Lounges or Qantas operated International Business Lounges (excluding Los Angeles Tom Bradley Terminal International Business Lounge) in accordance with the Qantas Money Platinum Credit Card Airline Benefit Terms and Conditions. Access and use are subject to Complimentary Lounge Invitation Terms and Conditions and the Lounge Entry Terms and Conditions. The Complimentary Lounge Invitation is able to be linked to another passenger travelling with the Primary Cardholder when travelling under the same booking. For Qantas Lounge locations visit here.

-

The Qantas Money Platinum Primary Cardholder is entitled to the Companion Fare benefit once per Anniversary Year. A discount applies on the base fares (excluding taxes, fees and carrier charges) of selected domestic flights for the primary cardholder and between one and eight others, travelling together on the same booking number, date and flight(s). The Companion Fare Benefit is not available on flights that form part of a Multi-City Flight Itinerary or Mixed-Class Flight Itineraries. For the avoidance of doubt, all flights and/or segments of the booking must be Qantas or QantasLink operated. Flight numbers that start with “QF” does not mean flights are operated by Qantas or QantasLink. Flights must be booked through the booking portal available via Your Online Access and must be paid for in full using the primary cardholder’s Qantas Money Platinum credit card. For full terms and conditions, see Qantas Money Platinum Credit Card Airline Benefits Terms and Conditions.

-

Earn rate for the Qantas Money Platinum credit card: 1.5 Qantas Point per whole AU$1 equivalent on International Spend; 1.0 Qantas Point per whole AU$1 on Domestic Spend up to and including AU$10,000 each Statement Period, 0.5 Qantas Points per whole AU$1 spent above AU$10,000 each Statement Period: plus 1 Additional Qantas Point per whole AU$1 on Qantas Spend. Eligible purchases are Eligible Transactions for Domestic Spend, International Spend and Qantas Spend as defined in Qantas Money Credit Card Rewards Terms and Conditions found at www.qantasmoney.com/terms-and-forms.

-

The interest free period applies to Retail Purchases when you pay the Interest Free Days Payment in full by the Payment Due Date.

-

Instalment plan offers are subject to eligibility and only available if your account is and remains in good standing (For example - your account is not in default, suspended or closed). Please refer to Section 5 of the Qantas Money Credit Card Terms and Conditions for the instalment plan terms and conditions.

-

Visit Mastercard for terms and conditions of their fraud protection policy.

-

Mastercard offers ID Theft ProtectionTM as serviced by a third party, Generali Global Assistance (GGA). Please read T&Cs at https://mastercardaunz.idprotectiononline.com/general/legal/terms-and-conditions. Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated. Terms and conditions apply.

-

Qantas Money Credit Card Concierge is a complimentary service available to the Primary Cardholder of a Qantas Money credit card. Refer to the Qantas Money Credit Card Rewards Terms and Conditions. Concierge Services is provided by Mastercard® Travel & Lifestyle Services. Mastercard® Travel & Lifestyle Services are provided by Ten Lifestyle Management Limited.

The Qantas Money Credit Cards App is owned and operated by NAB and supported on iOS15+ and Android 10+.