What are the benefits of setting up a Statement Instalment Plan?

Take control of your Qantas Money Credit Card repayments by converting the purchases on your statement into monthly instalments over a set term. Balance Transfers and other balances on a promotional rate, card fees, interest charges, cash advances and existing instalment plans are not eligible for conversion.

Lock in a 0% interest rate for an upfront fee

With a Statement Instalment Plan, you can access a 0% p.a. interest rate for up to 18 months for a one-off upfront fee^. This fee is dependent on the length of the instalment plan, as set up below:

| Length of Instalment Plan | Instalment Fee |

|---|---|

| 6 months | 3.99% of amount converted |

| 12 months | 7.99% of amount converted |

| 18 months | 9.99% of amount converted |

No fees for paying earlier

You can make additional repayments, or choose to pay off the instalment plan at any time, at no extra charge.

Keep your interest-free days

The interest free period applies when you pay the Interest Free Days Payment amount displayed on your statement by the Payment Due Date (excluding any Instalment Plan balance which isn’t due for payment by that Payment Due Date). No interest free period is available on Cash Advances or Balance Transfers.

Manageable monthly instalments

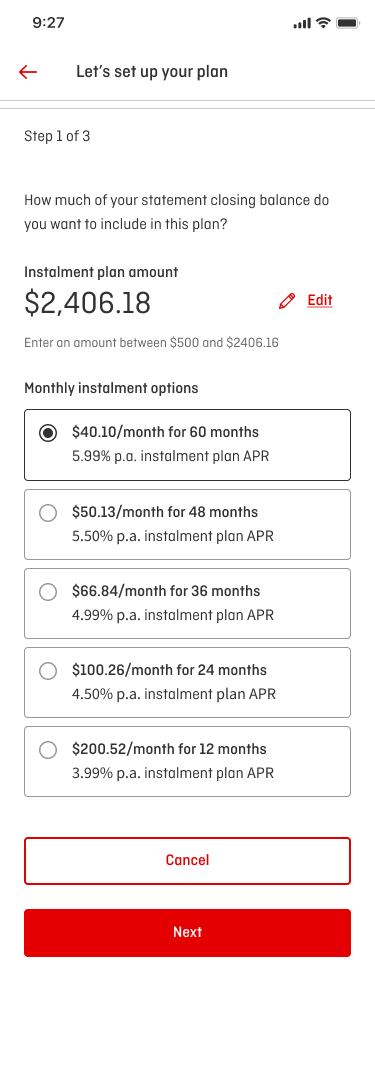

Choose the amount you wish to convert, then the length of your instalment plan, based on how much you want to pay each month.

How it works

- spend using card

- Set up a plan

- Pay each month

- Track your progress

Spend using your card

Once you receive your statement, you may be eligible to set up an instalment plan1 to pay off your purchases in manageable repayments.

Set up a plan

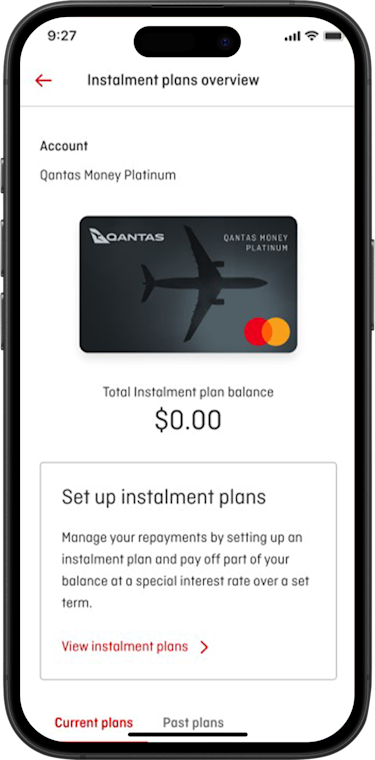

Log in to the Qantas Money Credit Cards App. On the ‘Home’ screen tap on ‘Instalment plans’ then follow the prompts to set up your plan.

Pay each month

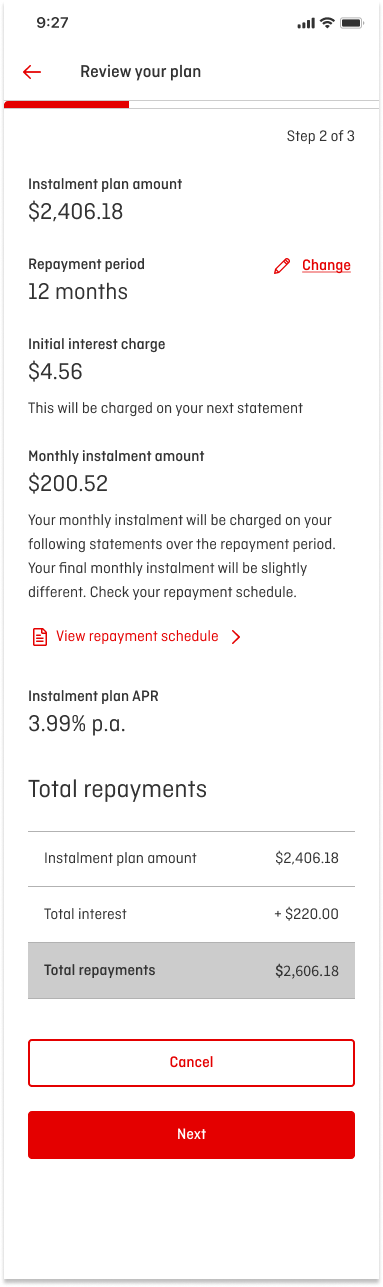

The repayment amount is included in your Minimum Payment Due.2 Check your monthly statement for more details.

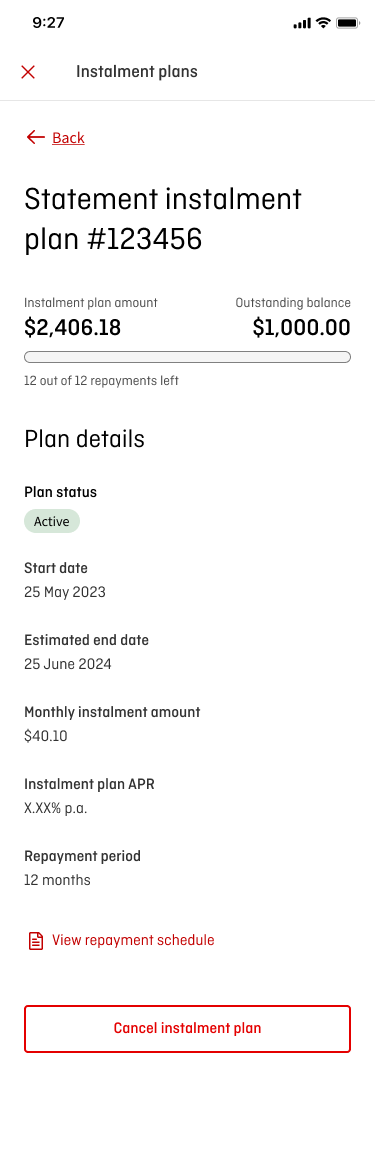

Track your progress

See how much you’ve already paid and what’s left to pay off in the Qantas Money app. Make extra repayments or pay off your balance, with no extra charge, by calling us.

Set up and manage

Set up an instalment plan

Log in to the Qantas Money Credit Cards App and go to the ‘Statements’ tab.

Tap on 'Instalment plans' under ‘How to pay your credit card bill’ section and follow the prompts to set up your plan.

Manage your instalment plans

To view details or cancel your active instalment plans you can do so via the 'Instalment Plan' tab on the home screen.

Frequently asked questions

You can repay the monthly instalment in a similar way to how you pay your credit card bill. Note that the monthly instalment is included in your Minimum Payment Due in your statement.2

During the cycle in which the instalment plan is set up, you will be charged an initial interest charge or the once-off setup fee which will be included in the Minimum Payment Due on your next statement. Subsequent statements will include an instalment for each month of the term.

You can pay off your instalment plan at any time without early repayment fees. Simply call us on 1300 992 700 (or +61 2 8222 2569 if you're calling from overseas).