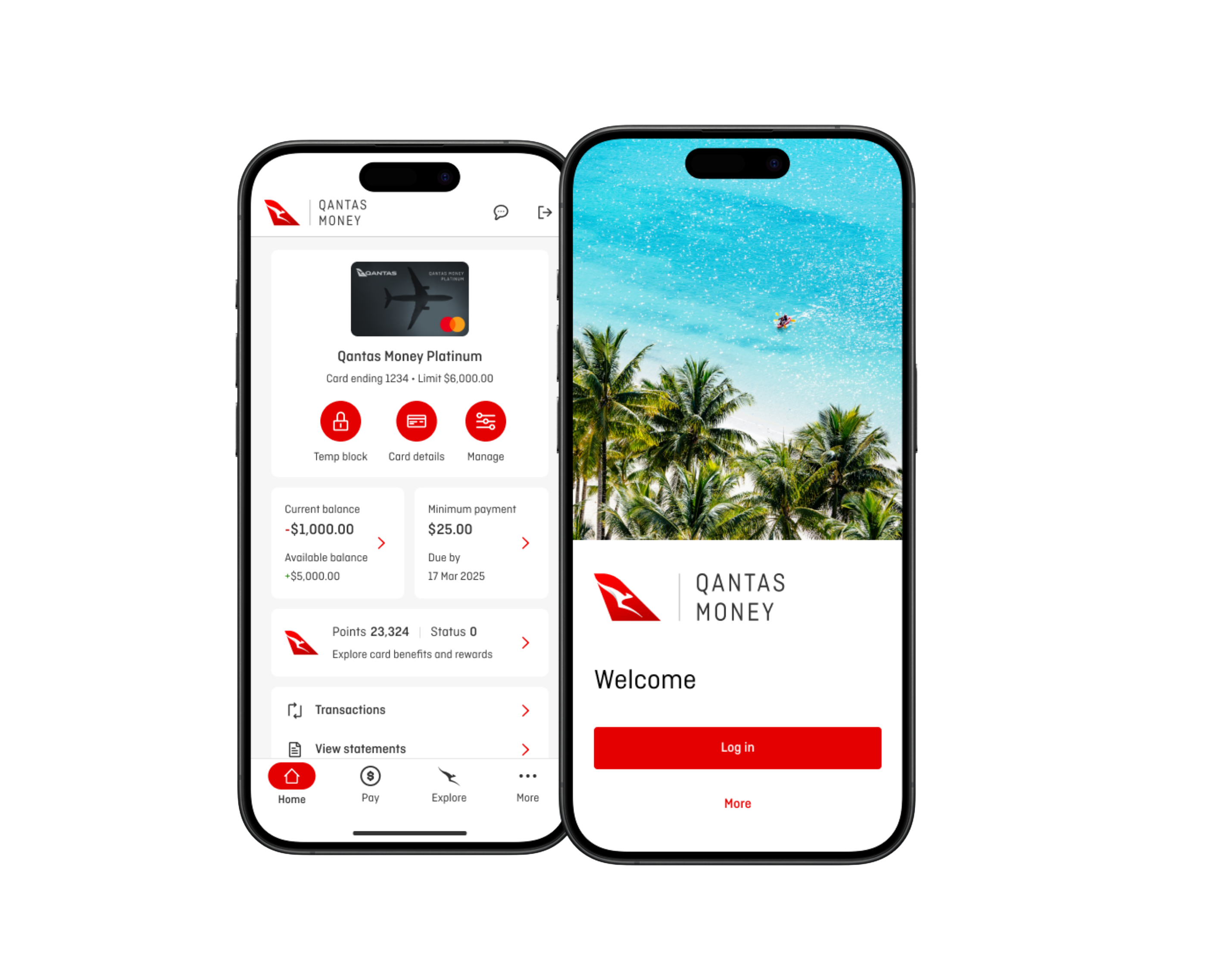

We’ve made some exciting changes to how you manage your credit card.

Qantas Premier Credit Cards has changed its name to Qantas Money Credit Cards, and with this comes a new app and online experience dedicated to managing your Qantas Money Credit Card.

To keep things running smoothly, it’s time to switch to the new experience. Here’s how to get started in just a few steps.

How to access your account

Download the new Qantas Money Credit Cards App:

- Download the new App from the App Store or Google Play store by searching "Qantas Money Credit cards".

- Use your Qantas Frequent Flyer (QFF) Membership number, Last Name and PIN to log in to the new app.

- Set up a passcode (which requires your date of birth). For faster access, you have the option to enable biometric login.

At Qantas Money Credit Cards Online:

- Visit qantasmoney.com and click the log in option for "Qantas Money Credit Card".

- Use your Qantas Frequent Flyer (QFF) Membership number, Last Name and PIN to log in.

This change only applies to you if you’re a Qantas Money Credit Cardholder.

An experience that's simple and secure. Here's what's different:

Other important changes

You can find detailed information about all of the changes in the communication we sent to your registered email or mailing address including:

New account number

You’ll see a new account number on your next credit card statement. If you are setting up new BPAY payments, be sure to use this new account number as your reference number. The embossed card number on your physical card remains unchanged

Instalment Plans in the Mobile App and Online are in development

For a period of time, you won't be able to set up any new Cash Instalment Plans. Any existing Instalment Plans you have set up before 8 September 2025 will continue. You also won’t be able to change the term of an Instalment Plan until further notice, but you’ll still be able to cancel or repay an Instalment Plan early.

Direct Debit arrangements

Your direct debit arrangements will remain in place so any regular payments such as bills and subscriptions will continue. If you use Easi-Pay, this has been transferred to a new system known as AutoPay. Learn more in our FAQ below "Are there any changes to Easi-Pay (direct debits)?"

Frequently asked questions

Yes, the following changes took effect on 8 September 2025.

-

Dishonour Fee: We’ve removed the $15 dishonour fee.

-

Total Cash Limit: If you had a Total Cash Limit that was less than your Credit Limit, this has increased to be equal to your Credit Limit. This may increase your liability in the case of Unauthorised Transactions.

-

Interest free days on Retail Purchases: You'll be able to benefit from interest free days on Retail Purchases even if you have a Balance Transfer by paying the Interest Free Days Payment by the Payment Due Date. The 'Interest Free Days Payment' is a new payment option shown on your statement if you have a Balance Transfer and/or Instalment Plan.

-

Annual Additional Cardholder Fee: The amount of this fee hasn’t changed, but there are some changes as to when and how it will be charged after 8 September 2025.

-

New Additional Cardholders: a pro rata fee will be charged from when the Additional Cardholder is added until the next annual fee is charged; and

-

Existing Additional Cardholders: the fee will be charged for cards that haven’t been activated by the time your next annual fee is charged. If you have an Additional Cardholder that hasn’t activated their card, you may want to consider whether they still require a card and if not, cancel it by calling us at 1300 992 700.

For more details, please review the full Terms and Conditions and Variation Notice, which we also sent to your registered email or postal address.

Yes. If you use EasiPay to automatically pay your account on the due date, this has been transferred to the new system and is now known as AutoPay.

-

If you currently pay the minimum repayment each month, AutoPay will now withdraw the Total Minimum Payment Due shown on your statement (which is the Minimum Payment Due plus any Overdue or Overlimit Amount). Unlike before, extra payments you make before the due date won’t reduce the amount withdrawn on the due date. For example, if your Total Minimum Payment Due is $100 and you pay $50 before the due date, AutoPay will still withdraw $100 on the due date. The only exception to this is if the extra payments you make cause the remaining Closing Balance owing on the due date to be less than Total Minimum Payment Due Amount. If this occurs, we’ll only withdraw the remaining Closing Balance.

-

If you currently pay the full amount of the Closing Balance each month, AutoPay will now withdraw the Closing Balance or the Interest Free Days Payment if you have an Instalment Plan or Balance Transfer. The Interest Free Days Payment will be a new amount that is only included on statements if you have an Instalment Plan or Balance Transfer. Unlike before, extra payments made before the due date may reduce the amount drawn under this payment option. If you don’t have an Instalment Plan or Balance Transfer, AutoPay withdraws the remaining Closing Balance owing on the due date. If you have an Instalment Plan or Balance Transfer, AutoPay will withdraw the lesser of the Interest Free Days Payment amount shown on your statement or the remaining Closing Balance owing on the due date.

No. You can manage your Qantas Money Credit Card in the dedicated Qantas Money Credit Cards App. This change will not impact the way you currently access other Qantas Money products.

No. How you earn your Qantas Points, your access to complimentary insurance, the Qantas Money Credit Card Concierge, exclusive Card Offers and the ability to add your card to a digital wallet has not changed.

We’ll send you an email each month to let you know when your statement for the month is available to view in the new Qantas Money Credit Cards App or Online. Here, you can view 2 years’ worth of previous statements.

Yes, if you have given your credit card details to a merchant to make regular payments, such as subscription services or regular bills, these payments will continue.

Yes, you can log into the new experience using your existing login details.

No, your points balance will no longer appear on your statement. You can view your Qantas Points balance on the home screen of the new Qantas Money Credit Cards App, the Qantas Money App, or by logging in to qantasmoney.com or qantas.com.au.

Yes. You can still use the same physical credit card, or the card stored in your digital wallet to make purchases or payments. You will see the same card number and expiry date on the Qantas Money Credit Cards App and Online, however the CVC will be different to the CVC on your physical card and will change every 18 hours as an additional security feature.

We’ve introduced ‘dynamic CVC’ in the new Qantas Money Credit Cards App and Online as an additional security feature. Dynamic CVC generates a new, temporary CVC in the Qantas Money Credit Cards App and Online every 18 hours and is different to the three-digit CVC printed on the back of your physical card. It changes regularly, making it more difficult for your card information to be misused.

It can be used for payments where you need to provide your card details to a merchant to pay for your subscription services or regular bills. You can also use the dynamic CVC when making online or over the phone purchases where you’re asked to enter or provide your card details to a merchant.

No, if you don’t want to use the dynamic CVC every time you make an online or over the phone purchase, that’s okay – you can still use the three-digit CVC printed on your physical card.

If you are currently sharing your data through Consumer Data Right / Open Banking, your active ongoing data sharing arrangements will be withdrawn on 7 September 2025. The Accredited Data Recipient(s) (i.e. who you are sharing your data with) will be notified.

From 8 September 2025, you will be able to create new data sharing arrangements after you have set up the new Qantas Money Credit Cards App or by logging in to qantasmoney.com. You will also be able to see your historical data sharing arrangements in your new dashboard. This will include any consents withdrawn on 7 September 2025. Please note that the historical consent data may take up to 72 hours to become available.

You can update your address and contact details via the Qantas Money Credit Cards App.

Go to More > Profile Settings > Manage details.

You can also update your address and contact details via the Qantas Money Credit Cards Online by clicking on “Profile Settings” at the top right corner and then “Manage details”.

Please note that changes to your Qantas Money credit card account will not update your Qantas Frequent Flyer details. To make changes to Qantas Frequent Flyer, please log in at qantas.com.au.

Our updated Terms and Conditions are effective from 8 September 2025, and we informed you by sending communications to your registered email or postal address.